Village Functions

Village Government

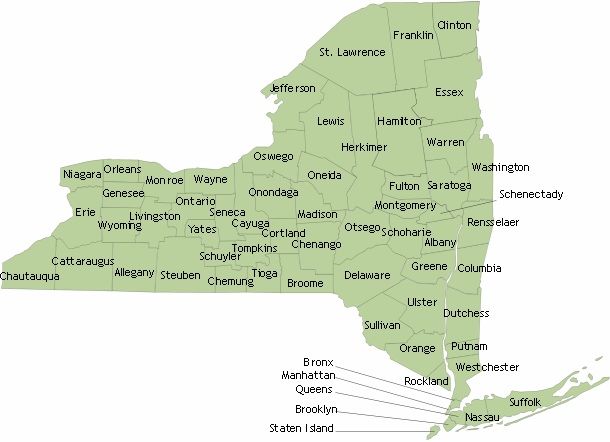

In New York State, the village is a general purpose municipal corporation formed voluntarily by the residents of an area in one or more towns to

provide themselves with municipal services. But when a village is created, its area still remains a part of the town where it is located, and its

residents continue to be residents and taxpayers of that town.

The first village was incorporated at the end of the eighteenth century. The village form of municipal organization became a prominent feature of the

state's growing metropolitan areas between 1900 and 1940. The patterns of village organization are similar to those of cities.

Many people think of villages as being small, rural communities. Population size alone however, does not determine whether one community becomes a village

and another remains as an unincorporated "hamlet" in a town. In New York State a village is a legal concept; it is a municipal corporation. The largest

village in the state, Hempstead in Nassau County, had more than 56,000 residents in 2000, while the smallest city, Sherrill, had 3,147. Fifty-two of New

York's 62 cities had populations in the year 2000 that were smaller than Hempstead's.

Villages were originally formed within towns to provide services for clusters of residents, first in relatively rural areas and later in suburban areas

around large cities. Today, many of the existing 556 villages are in the areas surrounding the state's larger cities. Many villages have public service

responsibilities that differ little from those of cities, towns, and counties, and village officials face the full range of municipal obligations and

challenges.

What is a Village?

A village is often referred to as "incorporated." Legally cities, towns, villages and counties are all "incorporated." Hence, there are no "unincorporated

villages" in New York State. The vernacular "incorporated village" likely came to be used because villages are areas within towns for which an additional

municipal corporation has been formed.

Many places in the state having large numbers of people living in close proximity are neither villages nor cities. Many have names, some have post offices.

Some, like Levittown on Long Island, have thousands of residents. If the people in such communities have not incorporated pursuant to the Village law, they

do not constitute a village. While many people refer to such places as "hamlets", the term "hamlet" actually has no meaning under New York law.

By definition, a village is a municipality which, at the time of its incorporation, met statutory requirements then established as prerequisites to that

incorporation. Although the Village Law now sets area and population criteria for an initial village incorporation, a number of existing villages have

populations smaller than the present statutory minimum.

Historical Development

The earliest villages in the state were incorporated partly to circumvent the legal confusion about the nature and scope of town government that resulted

from legislative modification of English statutes. Generally, in the decades after the Revolution, villages in New York were created because clusters of

people in otherwise sparsely settled towns wanted to secure fire or police protection, or other public services. Those inhabitants receiving the fire or

police service, and not the whole town, paid for such services. A forerunner of villages appears to have been a 1787 legislative act granting special

privileges to part of a town, entitled "An act for the better extinguishing of fires in the town of Brooklyn."

The appearance of the village as a formal unit of local government began in the 1790's. Villages were created by special acts of State Legislature, but the

starting date for this process is in dispute among historians due to a lack of precision in terminology in those early legislative acts. In 1790, the

Legislature granted specific powers to the trustees of "… part of the town of Rensselaerwyck, commonly called Lansingburgh." The term "village" first

appeared in state law in a 1794 enactment incorporating Waterford. The legislative act of 1798, providing for the incorporation of Lansingburgh and Troy as

villages, is seen by many historians as the first formal authorization in the state for the village form of government. This enactment included all of the

legal elements (including an incorporation clause and delegation of taxing and regulatory power) deemed necessary for a true unit of local government.

First mention of the village as a constitutional civil division appeared in a section of the 1821 New York State Constitution prescribing qualifications of

voters. The Constitution of 1846 required that the Legislature "provide for the organization of cities and incorporated villages." The Legislature passed a

general Village Law in 1847, but continued to incorporate villages through the enactment of special charters, as it had for the previous half-century.

Separate incorporation led to a variety of village government forms, even for villages of similar characteristics. In 1874, a revised State Constitution

forbade incorporation of villages by special act of the State Legislature. Since that time, New York State villages have been formed through local

initiative pursuant to the Village Law.

An 1897 revision of the Village Law required those villages with charters to comply with provisions of the Village Law that were not inconsistent with

their charters. It also gave the charter villages the option of reincorporating under the general law. Although numerous charter villages did

reincorporate, 12 villages still operate under charters. These are: Alexander, Carthage, Catskill, Cooperstown, Deposit, Fredonia, Ilion, Mohawk, Ossining,

Owego, Port Chester and Waterford.

In the first 40 years of the twentieth century, as people moved from cities into the suburbs, more than 160 villages were incorporated under the Village

Law. The rapid growth of towns in suburban areas in the late 1930's and following World War II emphasized the need for alternatives to villages. To provide

services, suburban areas made increasing use of the town special district. This had a profound effect on the growth of villages.Although more than 160

villages were formed from 1900 to 1940, only 31 new villages have appeared over the succeeding 66 years, and 24 have dissolved during that period.

There were 556 villages in New York State in 2006. They range in size from the Village of West Hampton Dunes with a 2000 Census population of 11, to the

Village of Hempstead, with a 2000 Census population of 56,554. The majority of villages have populations under 2,500, although there were 25 villages

between 10,000 and 20,000 population in 2000 and 10 villages with more than 20,000 population.

Over 70 villages are located in two or more towns. There are seven villages which are in two counties. One village, Saranac Lake, lies in three towns and

two counties. Five villages - Green Island inAlbany County, East Rochester in Monroe County, and Scarsdale, Harrison and Mount Kisco in Westchester County

- are coterminous with towns of the same name. A coterminous town-village is a unique form of local government organization. The town and village share the

same boundaries and the governing body of one unit of the coterminous government may serve as the governing body of the other unit (i.e., the mayor serves

as town supervisor and trustees serve as members of the town board).

Creation and Organization

The Village Law governs the incorporation of new villages and the organization of most existing villages. The 12 remaining charter villages are subject to this law only where it does not conflict with their respective charters.

Incorporation

A territory of 500 or more inhabitants may incorporate as a village in New York State, provided that the territory is not already part of a city or

village. The territory must contain no more than five square miles at the time of incorporation, although it may be larger in land area if its boundaries

are made coterminous with those of a school, fire, improvement or other district, or the entire boundaries of a town.28

The incorporation process begins when a petition, signed by either 20 percent of the residents of the territory qualified to vote, or by the owners of more

than 50 percent of the assessed value of real property in the territory, is submitted to the supervisor of the town in which all or the greatest part of

the proposed village would lie. If the area lies in more than one town, copies of the petition are also presented to the supervisors of the other affected

towns.

Within 20 days from the filing of the petition, the supervisor of each town affected must post and publish notices indicating that a public hearing will be

held on the petition. Where the proposed village is in more than one town, the giving of notice and subsequent hearing are a joint effort of the affected

towns. The purpose of the hearing is to determine only whether the petition and the proposed incorporation are in conformance with the provisions of the

Village Law. Other considerations and objections to the incorporation are not at issue. This formal hearing must be held between 20 and 30 days after the

date of posting and publication of notice.

Within 10 days after the conclusion of the hearing, the supervisor of the affected town(s) must judge the legal sufficiency of the petition. If more than

one town is involved, and the supervisors cannot agree on a decision, their decision is deemed to be adverse to the petition. Any decision made is subject

to review by the courts. If no review is sought within 30 days, the decision of the supervisor(s) is final. If the decision is adverse to the petition, a

new petition may be presented immediately. If the decision is favorable to the petition, or if the petition is sustained by the courts, a referendum is

held within the proposed area no later than 40 days after the expiration of 30 days from the first occurring of either the filing of the supervisors'

favorable decision or the filing of a final court order favorable to the petition. Only those residing in the proposed area of incorporation and qualified

to vote in town elections may vote in the referendum.

Where the proposed area lies in one town, an affirmative majority of those voting is required in order to incorporate. Where more than one town is

involved, an affirmative majority in the area proposed for incorporation in each town is required. If any required majorities are not obtained, then the

question is defeated, and no new proceeding for incorporation of the same territory may be held for one year. If a majority vote(s) in favor of

incorporation is obtained, and there is no court challenge, the town clerk of the town in which the original petition was filed makes a report of

incorporation.

TABLE11

Village Incorporations Since 1940|

VILLAGE |

COUNTY |

DATE |

|

Florida |

Orange |

08/05/1946 |

|

Prattsburg |

Steuben |

12/07/1948 |

|

Tuxedo Park |

Orange |

08/13/1952 |

|

Sodus Point |

Wayne |

12/30/1957 |

|

New Square |

Rockland |

11/06/1961 |

|

Atlantic Beach |

Nassau |

06/21/1962 |

|

Port Jefferson |

Suffolk |

04/09/1963 |

|

Amchir |

Orange |

09/09/1964 |

|

Pomona |

Rockland |

02/03/1967 |

|

Lake Grove |

Suffolk |

09/09/1968 |

|

Round Lake |

Saratoga |

08/07/1969 |

|

Sylvan Beach |

Oneida |

03/17/1971 |

|

Lansing |

Tompkins |

12/19/1974 |

|

Harrison |

Westchester |

09/09/1975 |

|

Pelham* |

Westchester |

06/01/1975 |

|

Kiryas Joel |

Orange |

03/02/1977 |

|

Rye Brook |

Westchester |

07/07/1982 |

|

Wesley Hills |

Rockland |

12/07/1982 |

|

New Hempstead |

Rockland |

03/21/1983 |

|

Islandia |

Suffolk |

04/17/1985 |

|

Cape Vincent* |

Jefferson |

04/15/1986 |

|

Montebello |

Rockland |

05/07/1986 |

|

Chestnut Ridge |

Rockland |

05/16/1986 |

|

West Carthage |

Jefferson |

07/22/1987 |

|

Pine Valley |

Suffolk |

03/15/1988 |

|

Kaser |

Rockland |

01/25/1990 |

|

Bloomfield* |

Ontario |

03/27/1990 |

|

Airmont |

Rockland |

03/28/1991 |

|

W.Hampton Dunes |

Suffolk |

11/19/1993 |

|

East Nassau |

Rensselaer |

01/14/1998 |

|

Sagaponack |

Suffolk |

09/27/2005 |

|

S.Blooming Grove |

Orange |

07/14/2006 |

|

Woodbury |

Orange |

08/28/2006 |

* Cape Vincent was created in 1853 but the proper incorporation paperwork was not filed until 1986.

* Pelham and North Pelham were consolidated into Pelham.

* Bloomfield was created by the consolidation of East

Bloomfield and Holcomb.

The report is sent to the Secretary of State, the State Comptroller, the State Office of Real Property Services, the county clerk and county treasurer of

each county in which the village will be located, and the town clerks of each town in which the village will be located.

Upon receipt, the Secretary of State files the report in his/her office and prepares and sends a Certificate of Incorporation to the clerks of each town in

which the village is located. The village is deemed incorporated on the date the report is filed with the Secretary of State. Within five days after the

filing of the Certificate of Incorporation, the clerks of each town in which the village is located jointly appoint a resident of the new village area to

serve as village clerk until a successor is chosen by the village's first elected board of trustees. Election of the board and mayor is held within 60 days

of the appointment of the interim village clerk, except in instances where the new village embraces the entire territory of a town. In that case the

election of village officers is held at the next regular election of town officials, occurring not less than 30 days after the filing of the certificate of

village incorporation.

The Legislative Body

The legislative body of a village - the board of trustees - is composed of the mayor and four trustees. However, the board may increase or decrease the

number of trustees, subject to referendum. Trustees are elected for two-year terms unless otherwise provided by the board of trustees and subject to

permissive referendum.

The village board has broad powers to govern the affairs of the village, including:

The mayor presides over meetings of the board. A majority of the board, as fully constituted, is a quorum. No business may be transacted unless a quorum is present.

Executive Branch

The chief executive officer of most villages in NewYork State is the mayor. Unless otherwise provided by the board of trustees, the mayor is elected for a

two-year term. In addition to his/her executive duties, the mayor presides over all meetings of the board of trustees and may vote on all questions coming

before that body. The mayor must vote to break a tie. The mayor is responsible for enforcing laws within the village and for supervising the police and

other officers and employees of the village. The mayor may share the law enforcement responsibility with a village attorney - who may handle prosecutions

for violations of village laws, and the county district attorney - who usually handles general criminal prosecutions in the county.

At the direction of the board of trustees, the mayor may initiate civil actions on behalf of the village or may intervene in any legal action "necessary to

protect the rights of the village and its inhabitants." Subject to the approval of the board of trustees, the mayor appoints all department and non-elected

officers and employees. Except in villages that have a manager, the mayor acts as the budget officer. The mayor may, however, designate any other village

officer to be budget officer. The budget officer serves at the mayor's pleasure.29 The mayor ensures that all claims against the village are properly

investigated, executes contracts approved by the board of trustees and issues licenses. In certain cases, when authorized by the board of trustees, the

mayor may sign checks and cosign, with the clerk, orders to pay claims.

At the annual meeting of the board of trustees, the mayor appoints one of the trustees as deputy mayor. If the mayor is absent or unable to act as mayor,

the deputy mayor is vested with and may perform all the duties of that office.

Village Managers or Administrators

In order to provide full-time administrative supervision and direction, some villages have created the office of village manager or administrator. The

position of village manager is created by a local law, which fixes the powers of the office and the term of the incumbent. As an alternative to direct

adoption of a local law establishing a village manager, a village may create a commission to prepare a local law establishing a village manager and

defining the manager's duties and responsibilities. The commission must issue a report within the time set forth in the local law, which can be no later

than two years after the appointment of its members.30 While there is no mandate that the commission prepare a local law creating a village manager, if the

commission does prepare such a local law, it must be placed before the voters at a referendum; the board of trustees need not approve the local law.

The village manager is usually assigned administrative functions that would otherwise be performed by the mayor. Under the Village Law, the manager may

designate another village official as budget officer, to serve at the pleasure of the manager.

Sixty-seven villages in New York State had an administrator or manager in 2007; they are listed in Table 12. Some of these individuals hold more than one

title and some are known as "coordinator".

TABLE 12

Villages Which Have Administrators/Managers|

Akron |

East Rochester |

Irvington |

Pelham Manor |

Southampton |

|

Alden |

Ellenville |

Lake Success |

Pleasantville |

Spencerport |

|

Amityville |

Elmsford |

Lawrence |

Perry |

Springville |

|

Ardsley |

Fairport |

Lowville |

Phoenix |

Sylvan Beach |

|

Attica |

Farmingdale |

Mamaroneck |

Port Chester |

Tarrytown |

|

Blasdell |

Floral Park |

Massapequa Park |

Port Jefferson |

Thomaston |

|

BriarclifManor |

Fredonia |

Massena |

Potsdam |

Valley Stream |

|

Brockport |

Garden City |

Monticello |

Rockville Centre |

Walden |

|

Bronxville |

Great Neck Estates |

Mount Kisco |

Roslyn |

Westbury |

|

Buchanan |

Groton |

Oakfield |

Rye Brook |

Westfield |

|

Croton-on-Hudson |

Hamburg |

Ocean Beach |

Scarsdale |

Williamsville |

|

Dobbs Ferry |

Hastings-on-Hudson |

Old Westbury |

Sea Cliff |

|

|

East Aurora |

Horseheads |

Ossining |

Seneca Falls |

|

|

East Hampton |

Huntington Bay |

Pelham |

South Floral Park |

SOURCE: 2007NYCOM Directory of City & Village Officials, New York State Conference of Mayors and Municipal Officials,2007.

Other Village Officers

The village treasurer is the chief fiscal officer of the village. The treasurer maintains custody of all village funds, issues all checks and prepares an

annual report of village finances.31

The village clerk has responsibility for maintaining all records of the village.32 The clerk collects all taxes and assessments, when authorized by the

village board, and orders the treasurer to pay claims. The clerk is required "on demand of any person" to "produce for inspection the books, records, and

papers of his/her office."33 The clerk must keep an index of written notices of defective conditions on village streets, highways, bridges, crosswalks,

culverts or sidewalks and must bring these notices to the attention of the board at the next board meeting or within 10 days after their receipt, whichever

is sooner.34

Unless local law provides otherwise, the mayor appoints both the clerk and the treasurer with the approval of the board of trustees. Terms are established

at 2 years and may be increased. In many villages, the offices of clerk and treasurer are combined and are held by a single person.

Where no village office of justice has been established, or where the office has been abolished, the functions devolve on the justices of the town or towns

in which the village is located.

Organization for Service Delivery

Differences in the size of villages and in the services they perform make it difficult to describe the organization of a "typical" village. Larger villages often have multidepartmental organizations similar to cities, while small villages may employ only one or two individuals. Functions performed by villages range from basic road repair and snow removal to large-scale community development programs and public utility plants. A number of villages operate their own municipal electric systems.

Financing Village Services

Like most local governments, villages have a strong reliance on the real property tax to finance their activities. In the 2004 fiscal year the real property tax accounted for nearly 45 percent of total village revenues in New York State. The balance of the revenues comes from a variety of sources; these include user charges and other revenue from water and sewer services, electric systems, airports and marinas, as well as license and rental fees and penalties on taxes. Special activities generated about 39 percent of all village revenues in fiscal 2004. Sales tax revenues in 2004 accounted for 5 percent of total revenues for villages. State and federal aid provided 11 percent of village revenue in 2004.

State Aid and Village Finance

State aid programs that provide funds to villages are Aid Incentives for Municipalities (AIM) program, mortgage tax, aid for the construction and operation

of sewage treatment plants and aid to youth bureaus and recreation programs. A more detailed discussion of revenue sharing and other state aid appears in

Chapter XI.

The mortgage tax is a state tax is collected by counties. The allocation to towns is made according to the location of the real property covered by the

mortgages upon which the tax was collected. For towns that contain a village within its limits, a portion of the town allocation is made to the village

according to the proportion the assessed value of the village bears to twice the total assessed valuation of the town. While a village under this formula

would receive aid even if no mortgages were registered in a village, the town may receive the greater amount of revenue, even though much of the property

that yields the revenue may be within villages in the town.35

Village Dissolution

Just as villages are formed by local action they can be dissolved by local action. Article 19 of the Village Law provides the procedure for village

officials and electors to disband their village. Since villages are formed within towns, the underlying town or towns would become fully responsible for

governing the territory of the former village after it is dissolved.

The dissolution process may be commenced by the village board of trustees on its own motion or through the presentation of an appropriate petition to the

board of trustees. If a proper petition is presented, the board is obligated to prepare a "dissolution plan" and to submit a proposition for dissolution to

the electors. If the board seeks to initiate the dissolution process on its own motion, it may submit a proposition to dissolve the village to the

electors, again in accordance with a plan for dissolution. In either case, the question must be decided by the voters of the village at an election.

The village board of trustees is responsible for preparing the dissolution plan. The village law lists 8 criteria which must be addressed in a plan. The

plan must contain provisions relating to: (1) the disposition of the property of the village; (2) the payment of outstanding obligations and the levy and

collection of the necessary taxes and assessments or same; (3) the transfer or elimination of public employees; (4) any agreements entered into with the

town or towns in which the village is situated in order to carry out the plan for dissolution; (5) whether any local laws, ordinances or rules and

regulations of the village in effect on the date of the dissolution of the village shall remain in effect for a period of time other than as provided by

section 19-1910, i.e., two years; (6) the continuation of village functions or services by the town; (7) a fiscal analysis of the effect of dissolution on

the village and the area of the town or towns outside the village; and (8) any other matters desirable or necessary to carry out the dissolution.

The village board of trustees must appoint a study committee to prepare a report on the dissolution of the village. The study committee must include at

least two representatives, who reside outside the village boundaries, from each town or towns in which the village is situated. A copy of the report must

be sent to the village board of trustees and supervisor of each town in which the village is situated. The report must address all the topics required to

be included in the dissolution plan and alternatives to dissolution. The committee may also propose a plan for dissolution for consideration by the board

of trustees. Prior to submitting its report, the study committee must hold at least one public hearing upon 20 days notice published in the official

village and town newspapers.

The village board of trustees must also hold at least one public hearing, which must be preceded by notice provided by certified mail to the supervisors of

the town(s) involved, and published at least 10 days but not more than 20 days prior to the hearing in the official newspaper of the town(s) and village.

Once the board of trustees' hearing is concluded, the proposition is generally presented to the village voters at the next regular or special village

election for officers held not less than 30 days after the board of trustees hearing.

The proposition to be submitted to the voters must contain the question of dissolution and, numbered separately, a plan for disposition of village

property, the payment of its outstanding obligations including the levy and collection of necessary taxes and assessments and such other matters as may be

necessary. Although all or any part of such plan can be made the subject of a contract between the village and the town prior to submission of the

proposition, the primary objective of this plan is not to legally bind either the village or the town. Rather, it is a document that will educate and

inform the resident village electors as to the consequences of their vote. By outlining an orderly program for the transfer to the town of village

functions, assets and properties, and for the disposition of any outstanding debts, obligations or taxes, the plan will provide the village residents some

picture - incomplete though it may be - of the tangible effects of the dissolution.

If the proposition is approved by a majority of those voting on the question, a certificate of the election must be filed with the Secretary of State and

clerks of each town and county in which any part of the village is situated. The village would then be dissolved as of the thirtyfirst day of December in

the year following the year in which the election took place. If the proposition is defeated, no similar proposition can be submitted within two years of

the date of the referendum.

TABLE13

Village Dissolutions in New York State Village|

Village |

County |

Date |

|

Roxbury |

Delaware |

04/18/1900 |

|

Prattsville |

Greene |

03/26/1900 |

|

Rifton |

Ulster |

08/18/1919 |

|

Union* |

Broome |

1921 |

|

LaFargeville |

Jefferson |

04/18/1922 |

|

Brookfield*** |

Madison |

12/31/1923 |

|

Oramel |

Allegany |

12/23/1925 |

|

Eastwood** |

Onondaga |

08/06/1926 |

|

Newfield |

Tompkins |

12/02/1926 |

|

Pleasant Valley |

Dutchess |

05/22/1926 |

|

Marlborough |

Ulster |

04/20/1928 |

|

Northville |

Suffolk |

05/16/1930 |

|

Old Forge |

Herkimer |

10/21/1933 |

|

Forestport |

Oneida |

06/18/1938 |

|

North Bangor |

Franklin |

03/24/1939 |

|

The Landing |

Suffolk |

05/25/1939 |

|

Downsville |

Delaware |

09/21/1950 |

|

Amchir |

Orange |

04/30/1968 |

|

Prattsburg |

Steuben |

09/22/1972 |

|

Pelham |

Westchester |

06/01/1975 |

|

N.Pelham |

Westchester |

06/01/1975 |

|

Fort Covington |

Franklin |

04/05/1976 |

|

Friendship |

Allegany |

04/04/1977 |

|

Belleville |

Jefferson |

04/20/1979 |

|

Rosendale |

Ulster |

05/23/1979 |

|

Savannah |

Wayne |

04/25/1979 |

|

Elizabethtown |

Essex |

04/23/1981 |

|

Bloomingdale |

Essex |

02/26/1985 |

|

PineHill |

Ulster |

09/24/1985 |

|

Woodhull |

Steuben |

01/13/1986 |

|

East Bloomfield |

Ontario |

03/27/1990 |

|

Holcomb |

Ontario |

03/27/1990 |

|

Pine Valley |

Suffolk |

04/04/1990 |

|

Ticonderoga |

Essex |

05/01/1992 |

|

Westport |

Essex |

05/29/1992 |

|

Henderson |

Jefferson |

05/23/1992 |

|

Schenevus |

Otsego |

03/29/1993 |

|

Fillmore |

Allegany |

01/13/1994 |

|

Mooers |

Clinton |

03/31/1994 |

|

Andes |

Delaware |

12/31/2003 |

* date of 1921 based on the last financial record on file at OSC; annexed into the village of Endicott, April, 22, 1964

** annexed into the city of Syracuse

*** based on referendum date

Trends

Several significant trends, issues, and problems affecting village government in New York have become apparent in the last quarter of the Twentieth Century.

Zoning

The power to zone the area of the village separately from the remainder of the town still provides an incentive for village incorporation. The 1972 recodification of the Village Law continues the authority of the board of trustees to regulate land use, lot sizes, and density of development. With certain exceptions, villages that adopt their first zoning law must establish a zoning commission to draft regulations and establish zone boundaries. They must also establish a zoning board of appeals to hear appeals from decisions made by the village official who enforces zoning regulations. A more detailed discussion of zoning and other aspects of land use regulation appears in Chapter XVI. It should be noted that the proliferation of villages in Nassau County resulted in a charter provision that grants zoning authority to towns within any territory incorporated as a village on or after January 1, 1963.

Village-Town Relations

Fiscal relations continue to be a source of contention between towns and villages. Village residents are liable for payment of taxes to the town in which

their village is located, as well as to the village in which they reside. Before the advent of the automobile, village residents rarely considered this

dual taxation unduly burdensome. However, the need for miles of paved town roads and the rapid growth of population in towns near the state's metropolitan

areas has greatly increased expenditures for town highways and highway-related items.

The State Highway Law exempts village residents from paying the costs of repair and improvement of town highways, thus relieving them of a substantial

portion of the town highway maintenance expense. Unless exempted by the town board, however, village residents must help bear the costs of town highway

equipment and snow removal on town roads. Village residents not exempted from such highway costs often feel that they are being taxed for town services

they do not receive or use in addition to being taxed for the same services within their village. Villages also regard as inequitable the rent the town may

charge for village use of the town highway equipment that the village residents have already helped pay for through taxation.

The question of who should pay for what services has been a source of contention between towns and villages since the 1950's, but it can be resolved

through local cooperative action. Towns and their constituent villages often undertake formal and informal cooperative ventures. Many share municipal

buildings as well as officials and employees, or engage in cooperative purchasing, auto maintenance, and emergency vehicle dispatching. For example, one

government may provide library, ambulance, landfill or recreation programs to the other at a negotiated fee.